Additional Buyer’s Stamp Duty (ABSD) is a tax levied on top of the Buyer’s Stamp Duty (BSD) when a person buys a residential property in Singapore. It is intended to cool the property market and prevent speculation.

ABSD rates are different for different types of buyers. There had been a number of changes to ABSD Rates. The latest is effective from 27 Apr 2023.

Singapore Citizens who buy their first residential property do not have to pay ABSD. However, if they buy a second or subsequent residential property, they will have to pay ABSD.

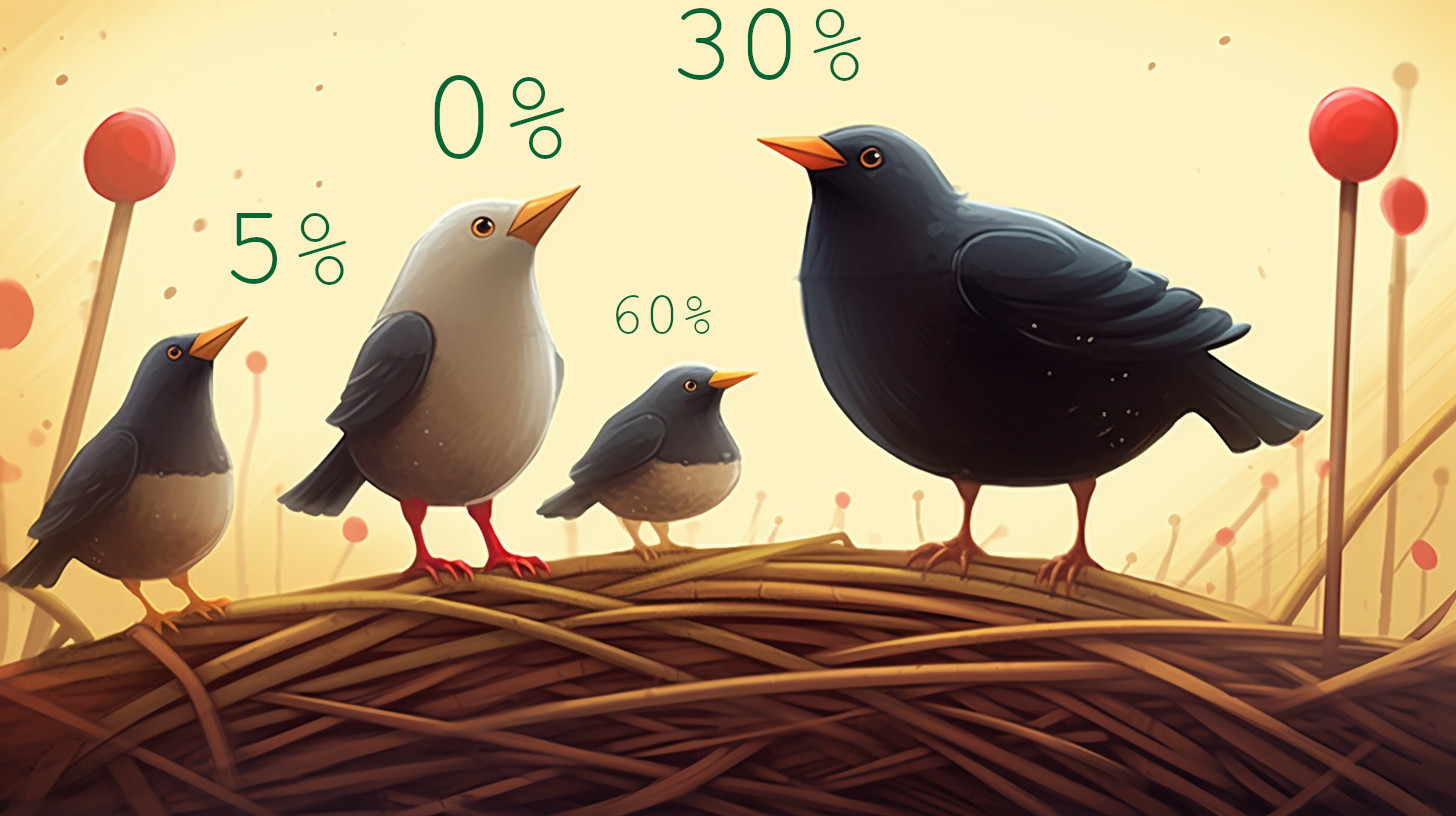

In summary, for Singapore Citizens:

- 0% for first property

- 20% for a second property

- 30% for a third and subsequent property

Singapore Permanent Residents (SPR):

- 5% for first property

- 30% for a second property

- 35% for a third and subsequent property

Foreigners:

- 60% for any property

Entities:

- 65% for any property

Housing Developers:

- 35% (plus additional 5%) or any property

For acquisitions made jointly by two or more parties of different profiles, the highest applicable ABSD rate will apply.

There are some exceptions to the ABSD rules. For example, married couples who buy a second property together may be able to get a remission of ABSD if they sell their first property within six months of buying the second property.

For more information, you may refer to IRAS website

The ABSD is a significant cost that should be considered when buying a residential property in Singapore. It is important to speak to a property lawyer or real estate professional to find out how the ABSD will affect your individual circumstances.

Please share if you liked this!